GoSource Appraisal Review Services

Our expert team ensures that every appraisal meets industry standards, reducing the risk of revisions and improving overall efficiency.

Why Choose Our Appraisal Review Services?

Quality Assurance & Compliance

We conduct detailed reviews to ensure reports align with USPAP standards and lender-specific guidelines, minimizing compliance risks.

Error Detection & Correction

Our experienced reviewers identify inconsistencies, missing details, and formatting issues to enhance report accuracy before submission.

Faster Turnaround Times

We streamline the review process, helping appraisers finalize reports efficiently and meet tight deadlines.

Objective & Unbiased Analysis

Our review approach ensures fairness and accuracy, reducing potential disputes and improving credibility.

Types of Appraisal Review Reports

At GoSource, our appraisal review services deliver accuracy and compliance for lenders, AMCs, and financial institutions. Our expert team ensures every report meets USPAP, UAD, and lender-specific guidelines, identifying discrepancies and offering clear, actionable feedback.

Single Family Residential Appraisal – 1004

The Single Family Residential Appraisal Report (Form 1004) is a comprehensive document used to assess the market value of a single-family home. It includes property details, neighborhood analysis, and comparable sales to ensure accurate valuation for mortgage lending.

Manufactured Homes – 1004C

The Manufactured Home Appraisal Report (Form 1004C) is used to assess the market value of manufactured homes. It evaluates the home’s structure, foundation, and compliance with HUD standards, along with comparable sales to ensure accurate valuation.

Multi-Family Appraisal - 1025

The Small Residential Income Property Appraisal Report (Form 1025) is used to evaluate 2-4 unit multi-family properties. It includes rental income analysis, property condition, and comparable sales to determine the property’s market value for mortgage lending.

Condominium Appraisal – 1073

The Individual Condominium Unit Appraisal Report (Form 1073) is used to assess the market value of a condominium unit. It evaluates the unit’s condition, project details, and comparable sales while ensuring the property meets lending requirements.

Exterior-Only Individual Condominium Unit Appraisal Report – 1075

The Exterior-Only Individual Condominium Unit Appraisal Report (Form 1075) is used to evaluate a condominium unit based on an exterior inspection. It includes property details, market trends, and comparable sales without an interior assessment, typically for low-risk transactions or refinancing.

Exterior Only Single Family Appraisal Report – 2055

The Exterior-Only Inspection Residential Appraisal Report (Form 2055) is used to assess the market value of a single-family home through an exterior inspection only. It includes property details, neighborhood analysis, and comparable sales, making it ideal for low-risk transactions or streamlined evaluations.

Two-to-Four Unit Residential Appraisal Field Review Report – 2000A

The Two-to-Four Unit Residential Appraisal Field Review Report (Form 2000A) is used to review and assess the accuracy of an appraisal for 2-4 unit residential properties. It ensures the appraisal meets industry standards by evaluating property details, comparable sales, and valuation conclusions.

Our appraisal review services go beyond the basics, covering 250+ checkpoints to ensure unmatched accuracy and compliance. We tailor review checklists to each client’s unique requirements and assign dedicated teams to deliver a seamless, personalized experience. Precision-driven, client-focused, and built for quality.

In the appraisal review process, a narrative report is a detailed, descriptive document that provides an in-depth analysis of an appraisal report’s accuracy, methodology, and conclusions. Unlike standardized checklists or form-based reviews reports, narrative reports offer comprehensive insights and professional opinions.

We provide comprehensive commercial appraisal review services, ensuring accuracy, compliance, and reliability in narrative reports. Our experts thoroughly analyze valuation methods, market data, and risk factors, delivering well-supported, USPAP-compliant reviews. With a detailed and structured approach, we help lenders and investors make confident, informed decisions.

When Are Narrative Reports Used?

🔹 Complex commercial properties

🔹 Litigation or legal disputes

🔹 High-value transactions requiring extensive justification

🔹 Cases where the original appraisal lacks clarity or requires deeper investigation

Partner with GoSource for Seamless Appraisal Reviews

Let our appraisal review services handle the complexities, so you can focus on delivering high-value property assessments. With deep expertise and a sharp eye for compliance, we ensure every report is accurate, consistent, and lender-ready.

GoSource Key Features

- 100% Manual Review

Our dedicated team conducts thorough manual assessments of appraisal reports, leaving no room for automated errors.

- Expert Reviewers

Our highly trained professionals possess expertise in various appraisal forms and lender requirements, ensuring comprehensive and accurate reviews.

- Customized Checklists:

We follow customized checklists based on client and lender preferences to align with specific requirements.

- Stringent Quality Control:

Our multi-level quality assurance process guarantees precision and compliance with industry standards.

- Versatile Software Usage:

We are proficient in using various software platforms, including ValuTrac, Engage, Mercury, eTrac k, Appraisalscope, Anow, and more.

- Error-Free Reports:

Our meticulous review process ensures error-free and precise appraisal report delivery.

- Rapid Turnaround:

We offer quick turnaround times, with standard review times as low as 2 hours and rush services within one hour.

- Feedback Analysis:

We maintain open communication with clients, conducting weekly/monthly feedback analysis to enhance our services continuously.

- High Volume Handling:

With the capability to handle over 10,000 files per month, we provide scalable solutions to meet your needs.

- 24/7 Support:

Our support team is available around the clock via phone, email, chat, and Skype to address any inquiries or concerns.

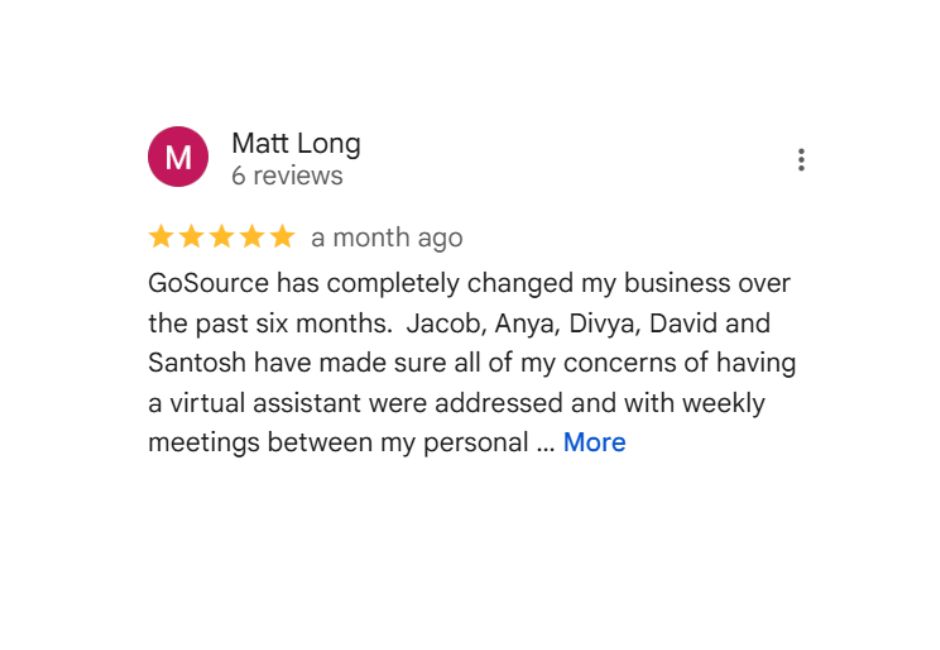

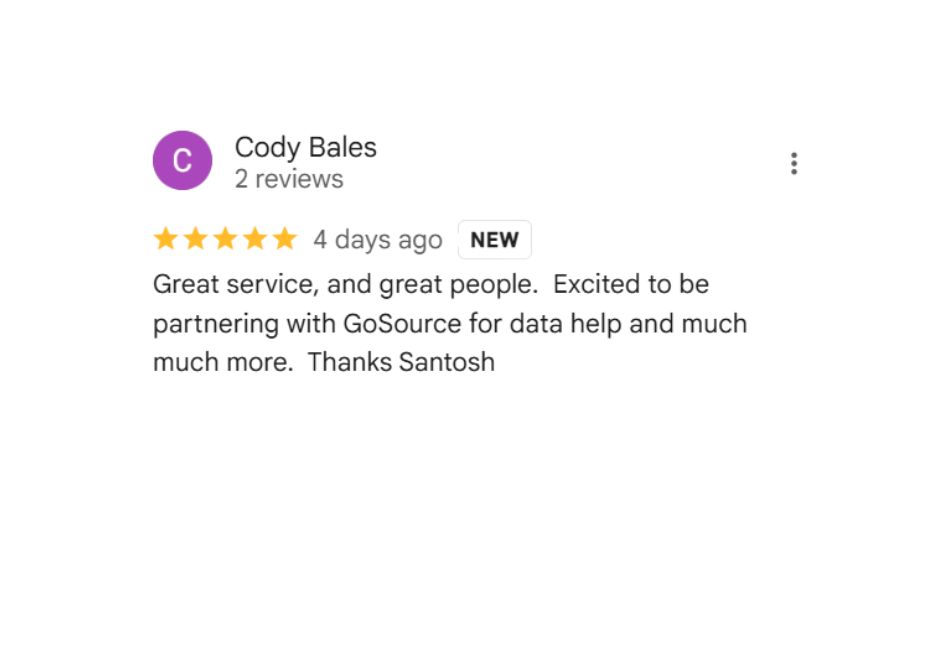

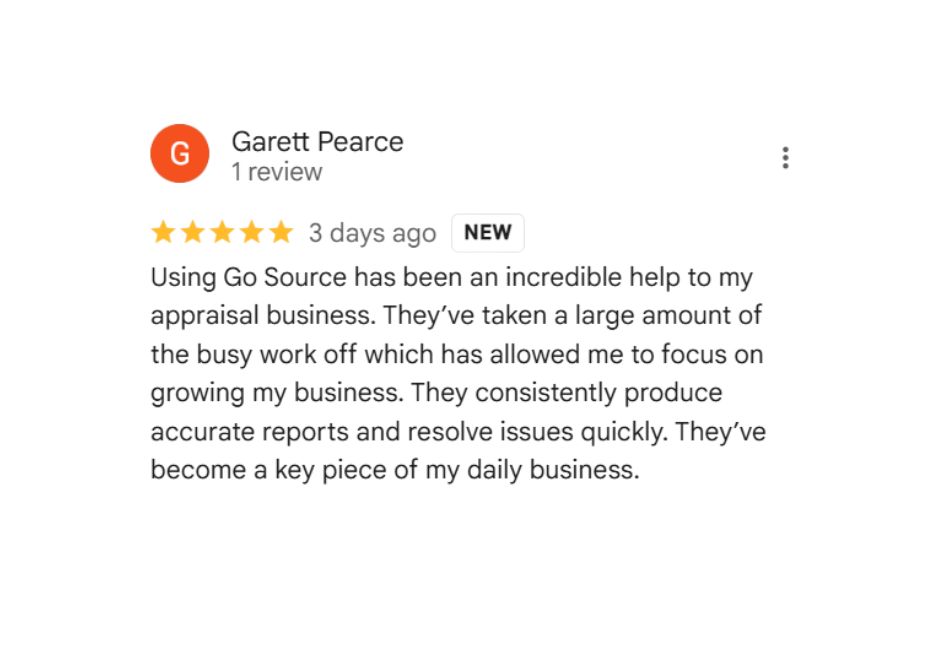

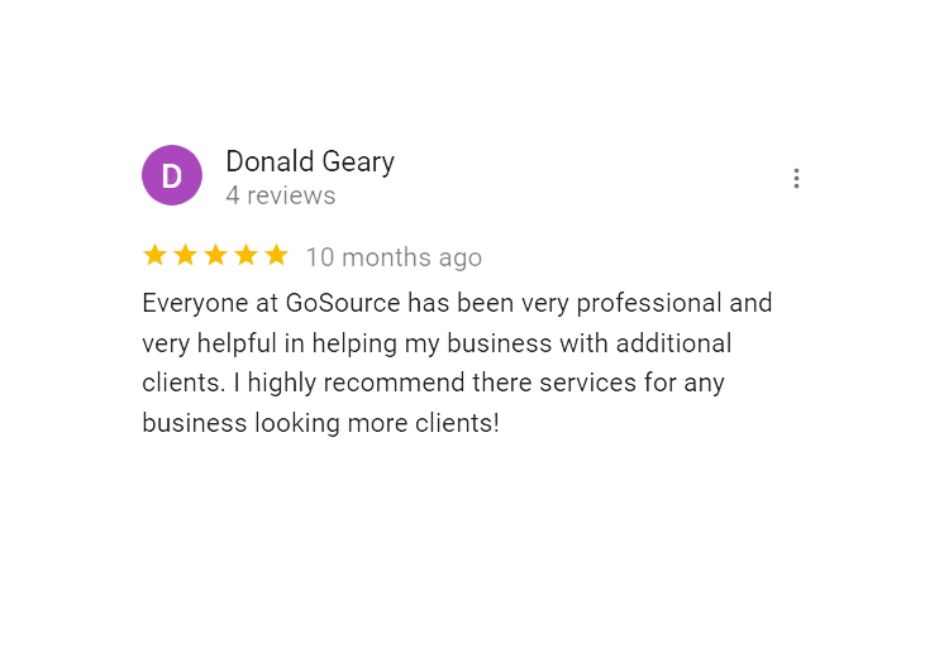

Client Feedback